Information Disclosure Based on TCFD Recommendations

The Chugoku Marine Paints (CMP) Group recognizes climate change as one of its important management issues, and in February 2023, it announced its support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

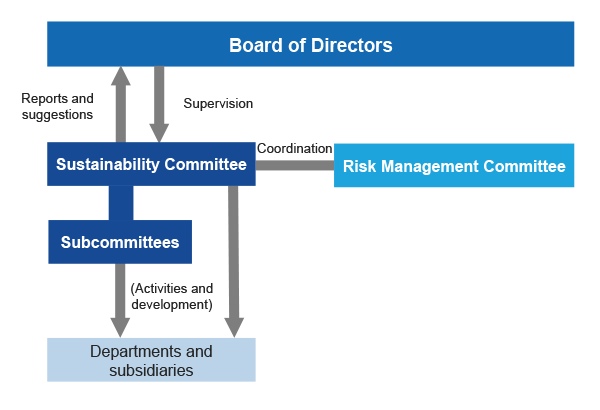

Governance

The Sustainability Committee has been established to strengthen the CMP Group’s sustainability initiatives, including climate change countermeasures, from the perspective of increasing the Group’s corporate value over the medium to long term. The Committee is chaired by the President of the Company, who is also the chief officer responsible for addressing climate change, and is composed mainly of executive officers and chiefs of each headquarters. The Committee is responsible for formulating policies, targets, and action plans for sustainability, promoting and monitoring initiatives on sustainability issues, and material issues. Details are reported to the Board of Directors once a quarter, and the Board of Directors monitors the sustainability activities and KPIs.

Climate change-related agenda

The Sustainability Committee mainly discusses the following issues related to climate change.

- ・Setting energy-related targets and reporting results

- ・Setting greenhouse gas (GHG) emission reduction targets and reporting results

- ・Considering the introduction of energy-saving equipment and renewable energy

- ・Setting waste recycling rate targets and reporting results

- ・TCFD compliance, matters related to climate change risks and opportunities

Governance system for climate-related issues

Strategy

The CMP Group considers the various risks and opportunities caused by climate change to be one of the important aspects of its business operations. We have examined the risks and opportunities that climate change issues pose to our Group with reference to the respective risk and opportunity items indicated in the TCFD recommendations. Additionally, while referencing climate change scenarios, we have conducted a scenario analysis on the identified risks and opportunities using two temperature range scenarios: the 1.5°C to 2°C scenario, in line with the Paris Agreement’s targets, and the 4°C scenario, which presupposes the continued emission of greenhouse gases at the current rate.

Scenario analysis

We conducted scenario analysis through the four steps below. For climate change scenarios, we selected the 1.5°C to 2°C scenario toward a decarbonized society and the 4°C scenario in which global warming progresses, analyzed and evaluated each risk and opportunity, and then examined countermeasures.

Analysis process

1.5℃ to 2℃ scenario

A scenario that aims to keep the global average temperature increase below 1.5–2°C compared to pre-industrial levels as efforts to achieve carbon neutrality to curb the effects of climate change gain momentum. In the 1.5°C scenario, the impact of policy and regulatory risks is assumed to be greater than in the 2°C scenario.

Scenarios used for reference:

- ・IEA Net Zero Emissions by 2050 Scenario

- ・IPCC SSP1-2.6

4℃ scenario

A scenario in which climate change countermeasures make no progress from the present level, and the average global temperature rises by approximately 4°C by the end of this century compared to pre-industrial levels. It is assumed that the impact of physical risks, such as the intensification of extreme weather events and the risk of sea level rise, will become more significant.

Scenario used for reference:

- ・IPCC SSP5-8.5

Overview of climate-related risks and opportunities for the CMP Group

Based on the climate change scenarios, we have identified the following important risks and opportunities that could affect the CMP Group’s business. As for the periods for considering risks and opportunities, we have positioned the short-term as being until fiscal 2025, which is the period for implementing our medium-term management plan, the medium-term as being until fiscal 2030, and the long-term as being until fiscal 2050.

In the 1.5°C to 2°C scenario, we foresee risks such as the strengthening of decarbonization policies leading to an increased cost burden due to the introduction of a carbon tax, surging raw material prices, and a decline in demand for marine coatings due to fewer fossil fuel carriers. However, we also recognize potential new business opportunities, including increased demand for environmentally friendly products such as low-friction antifoulings, and the development of coatings for floating offshore wind power generation facilities.

The worldview under the 4°C scenario is that rising temperatures will lead to more frequent and severe natural disasters, and that there will be physical risks due to sea level rise, but we also expect an increase in demand for antifoulings due to rising seawater temperatures.

| Risks / opportunities | Type | Factors | Impact on business | Financial impact | Timing of occurrence | Our response |

|---|---|---|---|---|---|---|

| Transition risks | Policy and legal | Introduction of carbon tax and increase in carbon tax rate | Increase in carbon tax burden | Medium | Medium term |

●Switch to renewable energy ●Energy saving by introducing highly efficient equipment |

| Increase in electricity costs | Medium | Short to medium term | ||||

| Technology | Switching to low-carbon raw materials | Increased procurement risk and costs due to growing demand for low-carbon raw materials | Medium | Short to long term |

●Shift from petroleum-derived raw materials to biomass-derived chemical substances |

|

| Market | Increase in raw material prices | Increase in costs due to higher demand for conventionally used vegetable oil raw materials | Medium | Short to long term |

●Improve factory utilization ratio ●Expand sales of high-value-added products |

|

| Change in demand in the shipping industry | Decrease in fossil fuel carriers | Medium to high | Long term |

●Develop demand for coatings for next-generation fuel carriers ●Expand sales in other areas such as pleasure boats and heavy duty coatings |

||

| Physical risks | Chronic | Sea level rise | Increased costs due to company base relocation | High | Long term |

●Consider relocation timing and location by conducting risk mapping ●Promote BCP-related investment |

| Acute | Intensification of natural disasters | Decrease in capacity utilization of business bases due to sudden disasters | High | Short to long term |

●Identify hazardous areas in advance by using regional disaster prevention maps ●Place sandbags, oil fences, and oil adsorption mats to prevent flood damage ●Plan emergency alternative production systems and plans (group production sites, outsourced manufacturing) |

|

| Opportunities | Resource efficiency | Monetization of unused resources | Reduction of waste disposal costs associated with reuse of coating containers and solvent distillation | Low | Short to medium term |

●Review manufacturing process ●Utilize IBC tanks |

| Products and services | Expanding markets for low-emission products and services | Increase in demand for environmentally friendly products (low-friction, high-performance antifoulings, biomass coatings, etc.) | High | Medium term |

●Strengthen R&D of environmentally friendly products and proactively make proposals to customers |

|

| Markets | Change in demand in the shipping industry | Increase in demand for coatings for next-generation fuel carriers | Medium to high | Medium to long term |

●Improve product competitiveness and strengthen sales activities |

|

| Expansion of low-carbon power sources | Increase in demand for coatings for offshore wind power generation facilities | Low to medium | Medium term |

●Develop and deploy in the market products that meet various standards |

||

| Other | Rising seawater temperature | Increase in demand for high-performance antifoulings to reduce the risk of fouling | Medium | Medium to long term |

●Strengthen R&D of high-performance antifoulings and proactively make proposals to customers |

Status of initiatives to reduce risks and realize opportunities

●Introduce renewable energy power and energy-saving equipment

The CMP Group is promoting the introduction of renewable energy and energy-saving equipment with the aim of reducing greenhouse gas emissions. We have introduced solar panels at our headquarters in Hiroshima, which also serves as our R&D base in Japan, and at our subsidiary, CHUGOKU PAINTS B.V., in the Netherlands, as part of our efforts to increase the use of renewable energy sources for our power consumption. In the future, we plan to gradually switch to renewable energy sources for the electricity we purchase from electric power companies. As for the introduction of energy-saving equipment, we have realized the changeover of lighting to LEDs at the Kyushu Factory. We will continue to promote reduction of energy loss and expansion of the use of renewable energy.

●Reduce greenhouse gas emissions with antifoulings

Our core product in marine coatings, antifoulings, prevents the increase in surface resistance caused by marine organisms like barnacles attaching to the hull during operations and maintains smoothness. This improves the ship’s fuel efficiency and contributes to the reduction of greenhouse gas (CO2) emissions.

In the shipping industry, as part of climate change measures, regulations and rules concerning ship fuel consumption and CO2 emissions have been enacted and are expected to be strengthened in the future. Also, rising seawater temperatures and changes in weather patterns such as heavy rains and typhoons due to climate change are activating marine life in some ocean areas, increasing the risk of hull fouling. In order to respond to these changes in the environment, demand is increasing for high-performance antifoulings with superior fouling prevention and enhanced fuel efficiency, and we expect demand to continue to grow over the long term.

(the dotted line indicates areas with high-performance coating, while the remaining areas have a general-purpose coating)

We have been focusing on the development of high-performance antifoulings and working to enhance our lineup and improve quality. In light of all of this, we are aware that addressing climate change challenges for ships will be a major opportunity for our marine coatings business to expand our business performance through an increase in sales of high-value-added products.

Risk Management

Process for identifying and assessing climate-related risks

The CMP Group has established the Basic Rules for Risk Management and has set up a Risk Management Committee, chaired by the Chief of the Administration Headquarters, to ensure efficient business operations. The Committee aims to prevent, detect, and correct any potential risks that may occur in the course of operations, as well as to prevent their recurrence, by establishing a risk management system and providing guidelines for responding to risks that arise.

Risks associated with climate change are identified and assessed by the Sustainability Committee after being extracted by a department or subcommittee. The significance of risks is determined by calculating an intrinsic risk score based on their potential impact and likelihood of occurrence. The Risk Management Committee examines response policies for highly significant risks and the Sustainability Committee for medium- to low-level risks.

Process for managing climate-related risks

There is a system in place where, after the Risk Management Committee and the Sustainability Committee have examined the response policy, they report to the Board of Directors at least once a year. In the process of implementing the risk response measures, the responsible headquarters or committee promotes response measures, and the Risk Management Committee and the Sustainability subcommittee constantly monitor the status of the response.

Process for integration into companywide risk management

Our risk management system is centered on the Risk Management Committee and includes the Compliance Committee, the System Planning & Operating Committee, and other committees. We consolidate the control system for prevention, detection, correction, and recurrence prevention of anticipated risks, and for the response to materialized risks. With regard to climate change risks, the Risk Management Committee and the Sustainability Committee collaborate to manage them in a process similar to companywide risks, creating an integrated risk management system.

Metrics and Targets

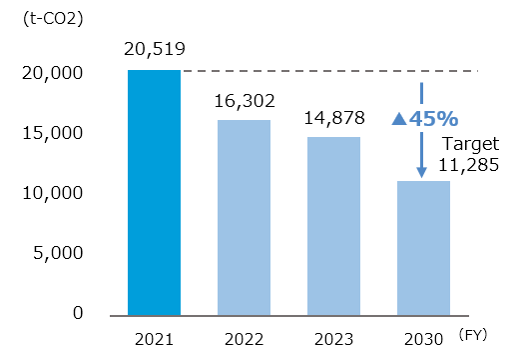

To assess the impact of climate-related issues on our business, we calculate greenhouse gas (GHG) emissions (Scope 1, 2, and 3) based on the GHG Protocol standards. Using 2021 as the base year, we aim to reduce Scope 1 and 2 GHG emissions by 45% by 2030 and achieve carbon neutrality by 2050.

Metrics and targets used to assess climate-related risks and opportunities

| Metrics | Target level |

|---|---|

|

Greenhouse gas emissions: Scope 1 and 2 |

・Reduce GHG emissions by 45% in FY2030 ・Carbon neutrality in FY2050 |

Actual greenhouse gas emissions

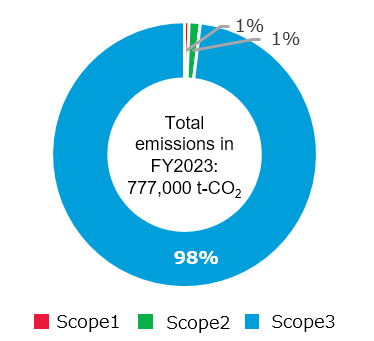

●Group-wide greenhouse gas emissions (Scope 1, 2, and 3)

| FY | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

|

CO2emissions (t-CO2) |

Scope1 | 5,554 | 4,168 | 4,205 |

| Scope2 | 14,965 | 12,134 | 10,668 | |

| Scope3 | - | 597,894 | 762,617 | |

*Calculations for groupwide Scope 3 emissions are available from fiscal 2022

Scope 1 and 2 emissions from FY2021 onward (Group-wide)

Breakdown of Scope 1, 2, and 3 emissions in FY2023

-

・Calculated in accordance with the calculation method of the Basic Guidelines on Accounting for Greenhouse Gas Emissions Throughout the Supply Chain (Ministry of the Environment and Ministry of Economy, Trade and Industry)

-

・Scope 2 emissions are calculated based on market standards. However, since the calculations in the Social & Environmental Report were based on baseline emission factors, they differ from the above emission figures.

-

・Scope 3 emissions are calculated using the Policy on Emissions Unit Values for Accounting of Greenhouse Gas Emissions, etc., by Organizations Throughout the Supply Chain (Ver. 3.2).